ESIC Login Employee

ESI represents Employees' State Insurance Corporation. It is a self-funding social security and medical insurance scheme for Indian employees.

ESIC is managed by a staff member of the state insurance coverage corporation.

It operates according to guidelines and guidelines specified in the ESI Act, 1948. ESIC is an autonomous body and comes under the Ministry of Labor and Employment.

ESIC can be accessed at the ESIC website.

The Employees' State Insurance Act, 1948 imagined a social security scheme that would safeguard the interests of IP members (employees).

Employees are covered by ESI in the event of illness, maternity, long-term or temporary physical disability, or death as a result of an on-the-job injury that results in a loss of wages or earning capacity.

What is ESIC and how does it work?

The Workers' State Insurance Corporation (ESIC) is an independent entity under the Ministry of Labour and Employment.

The main goal of this company is to raise money for the Employees' State Insurance (ESI) scheme.

This plan is primarily to cater to the medical requirements of the workers in India. It started off as a plan for factory workers today, including all the labour force utilized in the organized sector.

ESIC funds are mostly constructed out of contributions from workers and companies.

The percentage of contribution [( w.e.f. 01.07.2019)] made by the employer and worker differs; 3.25 % for companies and 0.75% for employees, making it an overall of 4% of the overall salaries paid.

It is handled by the ESIC according to the rules and regulations laid down in the ESI Act of 1948.

Employees in invoices of an everyday average wage up to Rs. 137/- are exempted from payment of contribution.

Companies will nevertheless contribute their own share with regard to these staff members.

Eligibility:

Employers:

ESIC registration is obligatory for all companies with a labour force of more than 10 staff members.

Employee:

To avail of these benefits and services offered by the ESIC, a person ought to fulfil specific criteria, set by the committee.

The scheme applies to -

- A worker, utilized in a non-seasonal factory with a strength of more than 10 staff members.

- The wage limit of employees has been set at Rs. 21,000 monthly (Rs. 25,000/-per each month in the case of persons with disability)., to be qualified for the ESI scheme.

This became effective on January 1, January 2017.

Advantages:

The advantages of ESIC are that, apart from the complete medical protection for self and dependents, the insured is entitled to different benefits in times of physical distress due to illness or injury.

If the guaranteed person loses his capability to earn because of some work injury, occupational hazard or perhaps death then the dependents will be entitled to a month-to-month pension.

ESIC Login

ESIC login can be divided into two separate parts for clear understanding-

- ESIC Employee login.

- ESIC Employer Login.

Let us see these two kinds of ESIC login in detail-

ESIC Employee Login

An employee who has been registered on an ESIC website is referred to as an insured individual or a beneficiary.

A special ESIC insurance number is produced for each beneficiary.

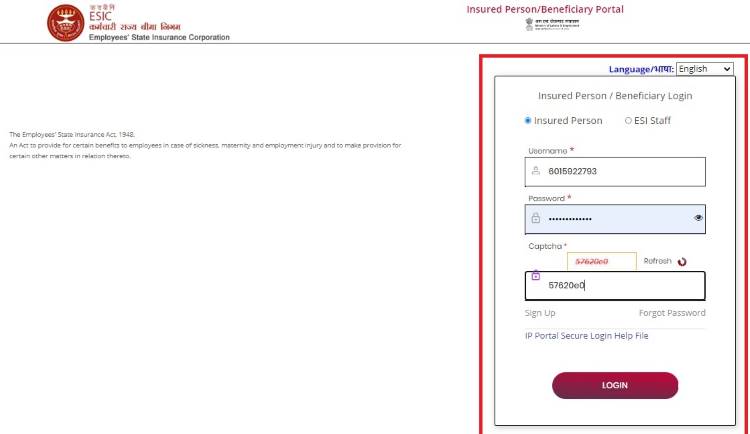

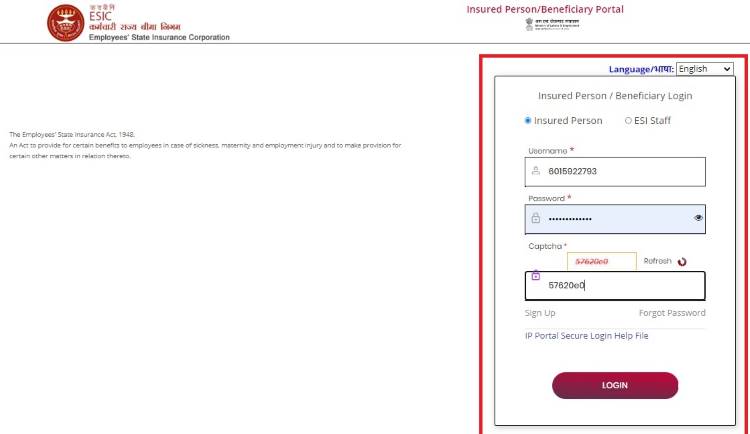

To do ESIC employee login, an employee must go to the main ESIC website (esic.in) and click on the insured person/Beneficiary tab.

ESIC employee login type will require details like insurance number and password to perform login on the ESIC website.

after entering your User ID, and Password, clicking the login button will open your profile page.

On this page:

- your personal information,

- Benefits of ESIC

- Your contribution Details

- Claims made by you and

- Other information will be available.

ESIC Employer Login

To do an ESIC company login, the employer needs to visit the ESIC Employer portal.

Information like employee family, family members' addresses and details of clinics or dispensaries would be required on the ESIC website.

When a staff member is registered on the ESIC website, a distinct insurance number will be generated for each employee on the ESIC website.

What is the ESIC Employer Portal login process?

Any employer with more than 10 workers needs to register themselves within 15 days at the Employees' State Insurance Corporation.

To do so, the employer is required to check out the online company website at www.esic.in.

After the employer is done registering himself, he will get a 17-digit employer code number along with ESIC portal login qualifications (login and password).

If not signed up yet, click here to understand the registration process for ESIC.

The employer needs to check if the 'employer website' is suitable for his browser.

The portal can be browsed by Google Chrome, Microsoft Edge, Mozilla Firefox and Opera browsers. But it is more compatible with Microsoft Edge or Mozilla Firefox.

What is the ESIC Employee Portal login procedure?

When the worker is signed up by the employer, he/she is described as an "insured individual'.

The insured person/employee can go to the employee portal to check their contribution to the ESI plan together with the benefits that they are entitled to.

The staff member can click the link attached to reach the employees' portal: https://www.esic..in/insured-person

This website is compatible with the majority of the web internet browsers.

The employee's website will look similar to the picture connected below:

- Your username is your "insurance number'. Log in using your Insurance number and enter the captcha.

These steps were shown above

After logging in, you will be able to see the contributions made by you and your company towards this scheme.

You will also be able to see updates and other advantages that you can declare and are entitled to.

Various sections of the ESIC portal.

The ESIC portal has been divided into the following sections:

1. Benefits

Benefits are the first major area of the ESIC portal. This section entails all ESIC advantages, consisting of the advantages discussed above.

2. Workplaces

This area on ESIC's main website includes details of all the offices of ESIC present in India.

3. Health Services

Information on ESI healthcare facilities, ESI dispensary, and the medical institute is offered under this section.

4. Tenders

Information on numerous upcoming tenders, in addition to eligibility requirements and dates, is provided in this section of the ESIC portal.

5. Recruitments:

This area on ESIC's main website contains info regarding upcoming ESIC recruitments.

What are the services offered by the ESIC website?

The ESIC website uses a wide array of services which are categorized broadly into 2 parts, which are Services for Employers and Services for Employees.

Providers for employers:

The services provided under this classification include the following for companies:

Employer Portal:

Using the company portal, the company can timely upgrade the employee information, maintain a wage contributing report, reply for absence confirmation, etc.;

Shram Suvidha Portal:

This portal enables the organization to satisfy all the labour laws that are applicable to it.

Compliance can be reported through a single kind, which makes it easy for those filing such forms.

There are key signs to monitor performance, therefore making assessment more objective in nature.

Solutions for Employees:

The services supplied under this classification include the following for employees:

- IP Portal:

The insured individual can log into the IP portal http://www.esic.in/employeeportal/login.aspx.

They can access their insurance number (same as user name) and establish the details of the contribution paid on their behalf, inspect their privileges to various benefits and so on.

- ESI beneficiaries can visit or can even be referred to tie-up hospitals for any medical requirements, consisting of emergency and non-emergency services.

Amid Covid-19, ESIC has permitted the insured to avail medical centres to tie up hospitals and private chemists, as a number of its health centres have been converted into Covid-19 devoted hospitals.

Scale of medical benefits:

The scale of medical benefits informs the insured persons and their members of the family about the recommended guidelines following which they can avail the medical advantages.

The ESI contribution rate.

As per ESIC act, 1948 and the newest upgrade.

There is no need for an ESI employee contribution in the case where the salary of a staff member is less than 100 Rs. per day.

It is recommended that ESI staff members go to the ESIC portal from time to time to be updated about the latest ESI contribution rate.

What are the advantages that are offered to workers?

A few of the advantages that can be availed by staff members are pointed out below:.

- Medical Benefits:

From the day a person gets into insurable employment, he and his family are provided with complete medical assistance.

No ceiling has actually been set on the treatment expenditure of either the person nor the household.

- Sickness Benefit:

It is a monetary compensation advantage, which is 70% of the total earnings.

This amount is payable just to the insured workers throughout the period of qualified illness, which lasts for a minimum of 91 days in a year.

- Maternity Benefit:

The maternity benefit for confinement/pregnancy is twenty-six weeks.

This can further be extended for another one month on medical suggestion at the rate of complete wage subject to contribution for 70 days in the preceding two contribution periods.

Benefit:

a) Temporary disablement advantage (TDB):

from the very first day of entering into insurable employment & irrespective of having actually paid any contribution in the case of employment injury.

90% of the wage is payable as long as the special needs continue under the momentary disablement benefit.

b) Permanent disablement advantage (PDB):

The advantage is paid at the rate of 90% of the wage in the form of monthly payments, relying on the level of loss of making capacity as licensed by a Medical Board.

Dependents Benefit:

DB is paid at the rate of 90% of wage in the form of month-to-month payment to the dependents of a departed insured person in cases where death happens due to work injury or occupational hazards.

Other Benefits:

Funeral service Expenses: A quantity of Rs. 15,000/- is payable to the dependents or to the person who performs the last rites from the first day of going into insurable work.

Confinement Expenses: An Insured Woman or an I.P. in respect of his better half in case confinement occurs at a location where essential medical facilities under the ESI Scheme are not offered.

ESIC details can be accessed at the ESIC portal.

To do ESIC worker login, a staff member needs to go to the main ESIC site and click on the guaranteed individual/ recipient tab.

ESIC worker login kind will require details like insurance coverage number and password to carry out login on ESIC website.

To do ESIC company login, the Employer needs to check out the ESIC Employer portal.

As soon as an employee is registered on the ESIC website, a distinct insurance number would be generated for each worker on the ESIC website.

Pingback: Www.esic.in/employee Portal/login.aspx - Portal Login

Pingback: How To Login Esic Portal For Employee - Portal Login

Pingback: Esic Employee Login Portal - Login-Portals.net

not login .password not create plz. help me

Esic card

Mobail no. Update nahi ho rha h

आप अपने अकाउंटेंट के माध्यम से esic रिप्रेजेन्टेटिव से कांटेक्ट कर मोबाइल नंबर अपडेट करा सकते हैं.

How can change old mobile number in my e pechan card please send. Solution

Now you can download ESIC Card. To Know process to Download ESIC card Watch this Video