ESIC Payment Receipt

The Employee's State Insurance Scheme offers a number of services to both employees and employers through its online platform and service portal.

Employers and employees are required to contribute to state insurance. This contribution can be made online via the organization's website.

This article discusses all of the essential elements of ESIC online payment.

This page will provide you with all the relevant information regarding ESIC Online download Payment 2023 receipt, including its purpose.

So, if you are an employer or employee who wishes to contribute to the employee's state insurance, you must read this page.

ESIC Online Payment 2023

The Employee's State Insurance Corporation has enabled online challan payments for its members.

The Employees State Insurance Corporation is an organisation that manages health insurance and social security programmes for employees in India.

Employers and employees must both make ESIC payments online (payment of a challan).

The rate at which the employer pays is 4.75 percent of the employee's salary. The rate at which the employee pays is 1.75 percent of the employee's salary.

All employees whose daily wages are less than Rs. 137 per day are exempt from contributing.

Online ESIC payments are available to account holders with internet banking capabilities.

Registered employers are not required to visit a government office to make this payment.

This will significantly reduce time and effort. Recipients are obliged to submit monthly ESIC payments online by the 15th of each month.

Get More Information About "ESIC Vyakti Kalyan Yojana" and " ESIC Online Payment" by Clicking Here. Objective

The primary purpose of ESIC online payment is to allow the online payment of challan.

The Employee's State Insurance Company has made it possible for people to pay their challans online, so they no longer need to visit government offices to do so.

This will save a great deal of time and effort and increase system transparency.

In order to pay the challan, Employers must have access to net banking.

Employers and employees are obligated to submit payments to the Employees State Insurance Corporation.

Employers can now pay challans from the convenience of their own homes.

How to download the ESIC Challan after making a payment

Step 1:

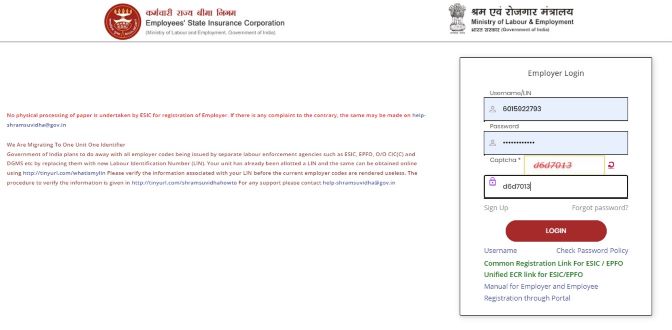

Go to ESIC official website : esic.nic.in or esic.gov.in.

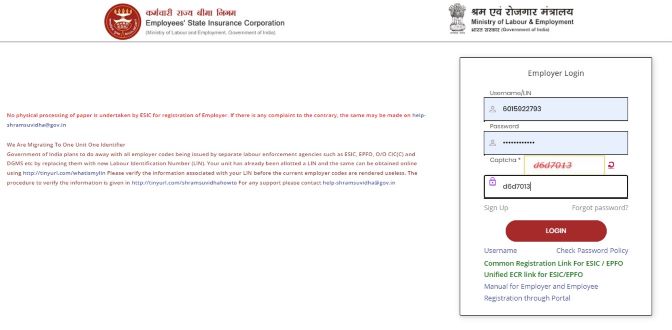

Step 2:

To get an ESIC challan after making an online payment, log in to the employer's ESIC portal with your ESI user ID and password.

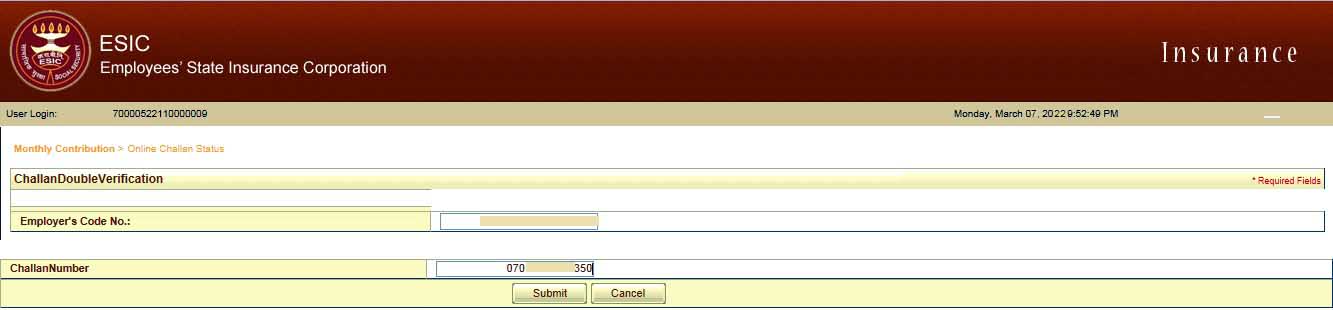

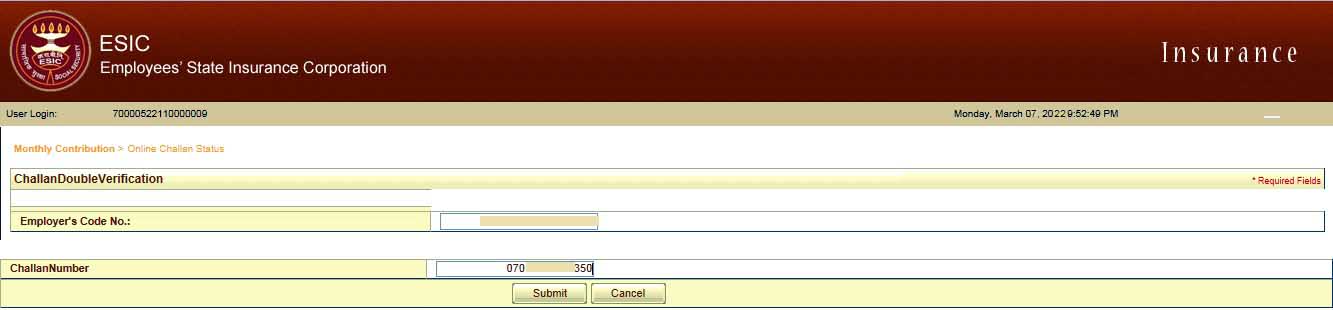

After logging in to the ESIC home page, click on "Online Challan Double Verification," which is on the right side of the ESIC home page under "monthly contribution."

Step 3:

A new window in the browser opens after you click on "Online Challan Double Verification." This is where you enter the challan number of the challan you want to download.

If you don't remember your ESIC challan number, read How To Retrieve Forgotten ESIC Challan Number In ESIC Portal

Step 4:

After entering the challan number, an automatically generated challan with the completed transaction will show on your screen.

Step 5:

Now you can download payment receipt by clicking on the Print option.

Process To Download Mobile App

- Initially, visit the official website of State Insurance Corporation employees

- The homepage will appear in front of you

- On the webpage, click the Umang-ESIC mobile app link.

- Following this link, you will be directed to a new page.

- Then you should select "install."

By following these steps, you will be able to successfully install the app on your smartphone.

FAQ’s

1. What is the payment due date for ESIC online payments?

The last day of the month to submit an ESIC payment is the 15th.

2. Does ESIC need to be submitted?

The ESI Act applies to all companies and businesses, even those with 10 or more employees who are paid less than 21,000 rupees a month.

3. If an employee's monthly wages exceed Rs. 21,000, can he be considered uninsured and the contribution deduction from his wages be discontinued?

If an employee's wages (excluding overtime work) exceed the wage limit specified by the Central Government after the beginning of the contribution period, he remains an employee until the end of the contribution period, and the contribution is deducted and paid from his full salary.

4. What are the results of a retrospective wage increase?

In the event that an employee's wages are increased retroactively, causing them to exceed the specified salary limit.

The increase will not affect the employee's coverage until the end of the contribution period during the period in which the increment was announced or declared.

Also, the contribution on increased earnings is due in the month in which the increment is announced.

There is no obligation to pay the arrears contribution for the period before the month of declaration, announcement, or agreement.